The report also encourages private network suppliers to develop strategies that address several challenges to private network adoption. These challenges include:

- Private network solutions are currently highly bespoke and complex; these are characteristics that limit the ability to scale. Early private network adopters are typically large corporations that have the resources to buy and operate complex solutions; smaller firms do not have these capabilities and will need networks that are simpler to buy and manage.

- The cost of private networks is currently prohibitively high (compared to Wi-Fi, for example) for the broader enterprise market.

- The awareness and understanding of private cellular networks is still low among enterprises, especially small and medium-sized enterprises (SMEs) and will take time to grow.

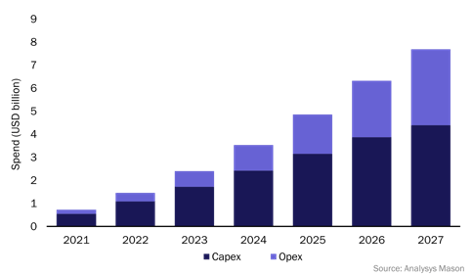

“The research firm expects enterprises’ spending (CapEx and OpEx) on private LTE/5G networks to reach $7.7 billion worldwide in 2027 and will grow at a CAGR of 48% between 2021 and 2027.”

Nuts and Bolts

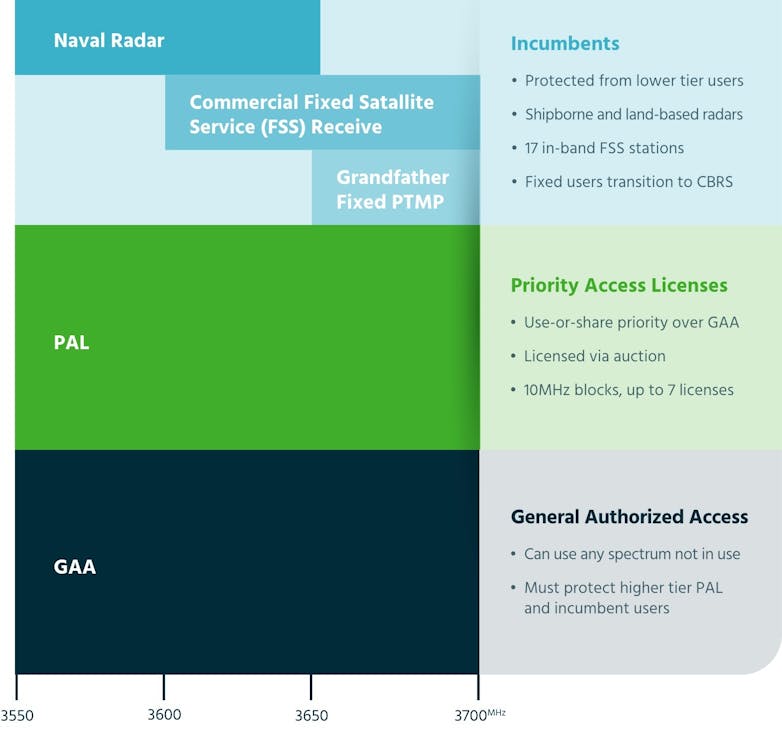

One strategy enterprises can leverage is CBRS spectrum that is dynamically allocated as it is needed. This makes spectrum more accessible and opens up new avenues for enterprises that want to build and manage their own private wireless networks.

Network elements needed include a dedicated core, dedicated radios, and management functions that can run on the enterprise’s infrastructure or can be leased from another company, such as a cloud provider.

By incorporating open-source technologies, companies can work with different vendors to create the right integrated solution for their business. Amazon Web Services (AWS), for example, offers a private 5G solution and Intel recently acquired the Open Networking Forum (ONF), which uses open-source components to deliver connectivity over wireless spectrum such as CBRS. Federated Wireless is also actively commercializing CBRS for both fixed and private wireless systems nationwide through partnerships with Intel, Amazon, and Microsoft.

Choosing a SAS Provider

SAS refers to Spectrum Access System, a cloud-based service that manages the wireless communications of devices transmitting in the CBRS band. It ensures that priority is given according to tiers: first to the incumbents, then to PAL, then to GAA.

The FCC certified a group of companies to serve as SAS managers with the responsibility to coordinate the use of the CBRS spectrum. The process is straightforward. Requests to use the CBRS band are made through the SAS cloud-based system. The system checks to see if the spectrum is available in the desired geographic location, and if it is, the request will be granted.

It’s important to vigorously vet your SAS partner prior to moving forward with your private network initiatives. Below are 6 questions you should ask each of the potential SAS partners you are evaluating:

- Question 1: How experienced is your SAS provider?

- Question 2: Does the SAS provider offer a comprehensive ESC network?

- Question 3: Does the SAS provider’s data use policy align with your objectives?

- Question 4: Do they provide end-to-end spectrum management?

- Question 5: Does the SAS provider have a good track record in terms of having secure systems?

- Question 6: Can the SAS provider adapt to your unique requirements, regardless of business size (e.g., enterprises vs WISPs)?

By asking these questions, you will be able to quickly evaluate whether the SAS provider you’re vetting possesses the qualities of a good provider. Not only must they be experienced and trustworthy, but they should also be able to provide reliable connections, have a high-quality ESC network, and ensure you and your customer’s data is kept secure.

“One strategy enterprises can leverage is CBRS spectrum that is dynamically allocated as it is needed. This makes spectrum more accessible and opens up new avenues for enterprises that want to build and manage their own private wireless networks.”

ADDITIONAL INFORMATION

Spectrum Life Cycle Management

A good SAS provider can offer solutions beyond monitoring your spectrum. Look for a SAS that offers additional services such as analyzing spectrum availability at the beginning, CPI certification, and RAN set-up assistance.

Prevents Interference Using a Comprehensive ESC Network

Not all SAS providers have a nationwide, triple-redundant, registered ESC network. If the SAS’s ESC network is lacking, it won’t be as effective in predicting when incumbents will need to use the spectrum, and you might experience interference or outages. A triple-redundant system ensures 99.999% spectrum availability, even if unexpected events require the incumbents to use more of it. Make sure your provider’s network is sufficient.

Provides 24/7 Customer Service

If you start experiencing interference, you want to be able to report it and have the SAS provider identify and address the cause of it right away. When choosing a provider, find out how you can reach them with any issues and how quickly they’ll respond. Your own customers expect you to respond quickly to requests, so you shouldn’t expect anything less from a SAS provider.

Protects Your Privacy

When you sign up with a SAS provider, you need to give them your location and customer information. Make sure that they’ll keep that information private and won’t share it with other WISPs or use it themselves. Don’t choose a SAS that’s also an Internet service provider. They might not share your information with others, but they could use it themselves to compete against you.